Investors cannot trade the Dow 100 directly because it represents the performance of a grouping of stocks. The Nasdaq Composite Index, also known simply as The Nasdaq, includes over 3,000 stocks and is regularly referred to by the media as a benchmark for the state of the U.S.

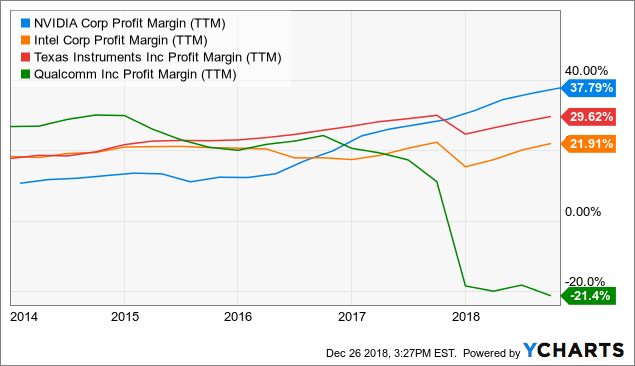

People sometimes confuse the Nasdaq-100 with the Nasdaq Composite Index. Some of the most well-known companies in the world are listed on the NDX including Apple, Google, Intel, Microsoft, Netflix, and Tesla.Īt the end of 2020, the index had a market cap of $15T.įinancial companies are excluded as they are listed separately on the NASDAQ Financial-100. Additional sectors in the index include Biotechnology, Health Care, Industrial, Media, Retail, Telecommunication, and Transportation. Technology companies dominate the index, accounting for about 50% of the index’s weight, followed by Consumer Services which make up close to 25%. stock market index comprised of the 100 largest companies listed on the Nasdaq Composite stock exchange, based on market capitalization. Nvidia will continue declining to find the bottom at $130 Source – TradingViewThe Nasdaq 100 is a U.S. We project that Nvidia Corporation will decline until it finds support at $130. It is not clear how low the whales think the stock could go. Put options selling the stock at $170 have been recorded. Whales are already bearish on Nvidia stock.

Sign-up for the Invezz newsletter, today. At the projected price, the RSI would read oversold, and the PE would show a fairer valuation.Īre you looking for fast-news, hot-tips and market analysis? Investors can wait to catch it at the bottom when the price is close to $130. This analysis considers that the trend would turn at a price of $130. We think that the RSI must decline to the oversold region before the stock can begin rallying. That is despite the stock gaining slightly over the last two weeks. Technical analysis shows that bears still dominate the market for Nvidia. Nvidia will continue declining to find the bottom at $130 Source - TradingView We think that Nvidia will decline to trade at a PE of 30. While it is not unusual to find technology stocks with such high PE ratios, the bear market is unforgiving.

Nvidia Corporation has a forward EPS of $3.78. The question, however, is whether the stock has found a bottom. That price is 51% below the peak price of $346. Nvidia Corporation ( NASDAQ:NVDA) is trading at $171.

0 kommentar(er)

0 kommentar(er)